WATS the problem?

In this post last year, we explained the joint venture structure of The Trusts and how it effectively hides information from the community. So what’s the problem with that? Well, while it is entirely legal, it is ethically questionable (at best) and goes against the intent of the legislation which was designed to enable the public to scrutinise their licensing trusts and hold them accountable. Combine that with The Trusts reluctance to respond to information requests and we’ve got a community organisation that is operating with impunity.

But how exactly does WATS Ltd make things less transparent? Here are a few examples:

Things The Trusts are definitely hiding from us:

Executive remuneration (including what the CEO gets paid)

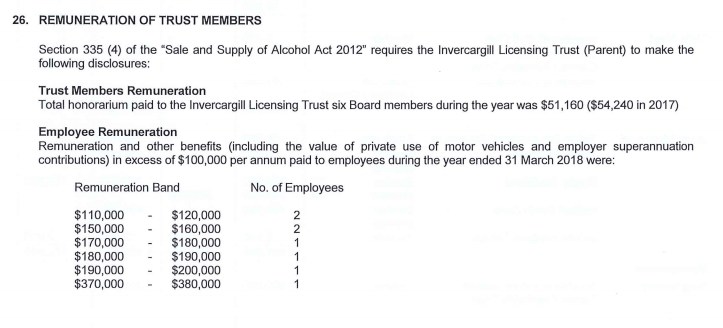

The legislation specifically requires licensing trusts to disclose certain details about employees paid over $100,000. This isn’t an unusual requirement – other monopoly operators (e.g. Invercargill Licensing Trust, Ruapehu Alpine Lifts, Zespri) publish this information each year. Neither of the West Auckland licensing trusts disclose any remuneration information at all.

There are undoubtedly a number of staff who earn more than $100,000. How many staff? We don’t know. How much more than $100,000? We don’t know. Embarrassing amounts? Maybe. The disclosure requirement is in the legislation for a reason. Dodging this requirement, regardless of the legality of the method, is not OK.

To demonstrate what we’re missing, here is the relevant section from the Invercargill Licensing Trust’s 2017/18 annual report.

WATS Ltd directors’ fees

The WATS Ltd board is made up of five independent directors and four licensing trust members (two from each trust). The amounts paid to these directors are hidden from the public.

The current members of the WATS Ltd board are:

- Brian Corban (Chair / Independent director)

- Campbell Barbour (Independent director)

- Andrew Bonner (Independent director)

- Timothy Livingstone (Independent director)

- Dianne Williams (Independent director)

- Neil Henderson (PLT)

- Sandra Coney (PLT)

- Lynette Adams (WLT)

- Penny Hulse (WLT)

We’ve made official information requests to get this information but The Trusts have chosen not to disclose. However, Sandra Coney stated at the November 2018 meeting of the PLT that she receives $27,000 annually for her directorship of WATS Ltd (kudos to Sandra for answering). Interestingly, this information was not captured in the meeting minutes. We still have no idea how much the independent directors or the Chairman are being paid.

Is there something dodgy going on here? Probably not… but why such secrecy?

And of course, the money paid to these Directors goes into private pockets and is not available for the community. Is it money well spent? We don’t know, because we don’t even know how much we are spending!

Community grants

The legislation also requires licensing trusts to provide a list of grants made each year. Again, neither of our licensing trusts provide any such lists.

How is that possible? The Trusts use two mechanisms to avoid publishing specific information about their ‘giving back’:

- By channelling their giving back through WATS Ltd, the Trusts can avoid disclosures that would normally be required in their audited financial statements;

- All of The Trusts’ giving back is setup so it can be accounted for as operational expenses and not grants. From a financial reporting (and probably a tax perspective), the entire giving back programme is classified as advertising and sponsorship.

But why wouldn’t they want to publish a list of grants? The Trusts enjoy a great deal of public goodwill arising from confusion between ‘The Trusts‘ and ‘The Trusts Community Foundation‘. Most people don’t distinguish between these two organisations and The Trusts get the credit for ALL of the grants. If The Trusts published lists, it would be much clearer what they actually give back. The confusion is valuable… The Trusts Community Foundation distributed $12 million in 2017/18 and that’s an awful lot of PR to give up.

Things The Trusts might be hiding from us

We’ve requested information from The Trusts to assess if anything untoward is going on. The Trusts haven’t given us any useful information and, while we’re waiting for the Ombudsman to sort it all out, we can only speculate.

To be clear, we are not accusing The Trusts of doing anything illegal. We have no evidence to suggest that they are doing anything dodgy. But we can’t tell if something stinks or not because they won’t provide any information to clarify.

Burying head office costs

WATS Ltd buys supplies and on sells them to the licensing trusts (including the booze). The transfer price policy (i.e. what price the licensing trust pays WATS Ltd) dictates how much of the head office costs are ‘baked into’ the cost of goods and how much appears as an expense. The effect of this is to move costs in the published accounts between the ‘cost of goods’ line and ‘administration expenses’ line. This means that things like travel and entertainment expenses (e.g. long lunches) could be reported (i.e. hidden) in the purchase price of their goods.

It’s not just the price they charge themselves for the booze though, they also have a good amount of discretion about other charges between the licensing trusts and WATS Ltd. For example the Portage Licensing Trust receives rents from WATS Ltd each year – presumably for use of their head office and warehouse. Their head office site is currently valued at $12,350,000 and the rents paid by WATS Ltd for the last 3 years were $94,000, $92,000 and $25,000. There’s also a service station and a West Liquor on that site but it does look like WATS has a pretty sweet deal there (imagine renting a house worth $12 million for just $500 a week!). If PLT were to charge a higher rent this would increase the administration costs in the published accounts; probably not something The Trusts want. Not surprising then that PLT charges a very low rent indeed.

Hiding rebates from suppliers

Commercial agreements between the big liquor suppliers and retailers/venues can get pretty cosy. Suppliers often contribute to advertising and promotion costs and they might even contribute to the cost of a fit-out or refurbishment if the venue agrees to put their products on tap / first pour. Sometimes rebates are tied to overall spend rather than a single purchase. For example, it could be agreed that if a customer spends over $10 million in the financial year, the supplier will pay their customer a rebate of $200,000 (effectively a retrospective 2% discount).

Because WATS does the purchasing, any contributions or rebates received would most likely be paid to WATS. Without the WATS financial statements, we can’t see how much cash (if any) WATS receives from the liquor companies and if these payments are passed on to the licensing trusts. The overall effect could be to inflate their cost of goods and decrease their administration expenses.

Avoiding public scrutiny of related party transactions

To enable public scrutiny, licensing trusts are required to disclose any transactions with related parties (e.g. any organisations associated with the elected members or senior staff). This is important. If a licensing trust were to spend a large amount of money with the ‘Elected Member Family Trust’ for example, the public would be rightly suspicious that something dodgy is going on.

But with the WATS financials hidden away, The Trusts can avoid disclosure (and the associated public scrutiny) by making sure that any transactions go through WATS. Too easy!

Understating their cash balance

Our licensing trusts have a habit of holding a lot of cash. Their cash balance over the last 3 years has been $12 m, $14 m and $16 m. But we don’t actually know how much cash they’re holding in total because the WATS balance is hidden. WATS has had current assets of about $12 m for the last 3 years… how much of that is cash that could be distributed to the community (or at least invested)?

‘Donations’ to their favourite clubs

We’ve heard rumours that some local sports clubs have recently been receiving five figure cash deposits from The Trusts without explanation or documentation. The only scrutiny of these sorts of ‘donations’ would be the audit of the annual accounts by the Auditor-General. If those payments were not illegal (and The Trusts are completely free to use our money for ‘any philanthropic purpose’), there would be absolutely no public disclosure.

Is this normal?

It’s important to note that other licensing trusts do not use joint venture structures like this. The Invercargill Licensing Trust is the only other licensing trust of a similar scale and their annual report provides ALL the information described in the legislation including lists of grants, executive remuneration, and comprehensive lists of related party transactions. The Mataura Licensing Trust (the only other remaining trust with monopoly rights) also makes all the legislated disclosures in their annual report.

The joint venture structure employed by The Trusts and their use of it to avoid legislated disclosures is scandalous. They are blatantly circumventing the intent of the legislation. It might not be criminal… but it should be.