Are The Trusts actually profitable?

Fundamental to the argument for keeping the monopoly in West Auckland is that the profits from selling alcohol are returned to the community. So one of the first questions we need to address is: “Are ‘The Trusts’ actually profitable?”

In short, yes. But is their core business (their bottle stores, bars and a hotel) profitable? That depends, and I would argue that they are not – at least not without their gaming machine revenues.

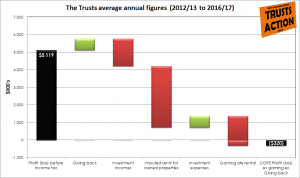

In the last 5 years (2012/13 to 2016/17) The Trusts recorded profits before tax of $5.1M per year on average. If we take out incomes from their investments and the rents they receive from the poker machine operator (TTCF Ltd), this figure reduces to a $0.32M per year loss. So without the pokies, the Trusts core business has been making a loss!

|

Average annual figures 2012/13 – 2016-17 ($000’s) |

|

| Profit (loss) before income tax | 5,119 |

| Giving back | 639 |

| Investment incomes | (1,549) |

| Imputed rents for owned properties | (3,489) |

| Investment expenses | 651 |

| Gaming site rental | (1,690) |

| CORE Profit (loss) ex gaming ex Giving back | (320) |

The Trusts average annual figures (2012/13 to 2016/17)

“Bullshit” I hear from the other side of the room. Well, there are a few assumptions that underpin this analysis, so for those who are interested the details are at the end of this post.

So, how on earth are they not making a profit? Economic theory would suggest that a monopoly operator should be persistently making “super-normal” profits; that is, profits greater than those that can be sustainably achieved in a competitive market. But The Trusts booze business is struggling to break even. Why is that?

There are a few possible reasons:

-

- The Trusts monopoly is not perfect. In economic terms, there is good availability of substitutes. Residents can choose between visiting their local Trusts operated bar or travelling outside the district. Or they might choose a different experience and visit a local licensed restaurant instead. Residents can also travel outside the district to buy their booze or order it online. So while The Trusts have a monopoly on taverns and off-licenses in West Auckland, if their offering isn’t good enough, customers will trade-off the cost and inconvenience of travel against the greater satisfaction they’ll get from somewhere else. The Trusts in West Auckland don’t wield the same power as an operator where fewer substitutes are available (like Invercargill).

- The off-trade in NZ is dominated by two types of organisations. Very large organisations (i.e. the supermarkets and the breweries) or small owner-operators (usually franchises). The supermarkets and breweries have the advantage of economies of scale. Breweries also have the advantage of vertical integration (i.e. they’re selling products they produce/distribute themselves). Conversely, owner-operators are small, simple businesses where the owner is directly involved in the day-to-day operations (in economic parlance = no agency costs). The Trusts does not enjoy any of these advantages.

| Banner | Number of outlets | Ownership |

| Thirsty Liquor | 150+ | Franchise |

| Super Liquor | 135+ | Franchise / Lion NZ |

| Liquorland | 100+ | Franchise / Foodstuffs |

| Liquor King | 40 | Lion NZ |

| West Liquor | 21 | The Trusts |

| Village Wine & Spirits | 4 | The Trusts |

-

- It is difficult to assess the efficiency of The Trusts without undertaking some sort of benchmarking exercise. However, it is highly unlikely that The Trusts competitive environment (i.e. the monopoly) and the governance model (i.e. trust members appointed by public elections) would result in an organisation with the same level of efficiency as a privately owned company in a fully competitive environment. NB – The joint venture arrangement also makes it particularly difficult to assess the efficiency of The Trusts, but we will continue to pursue The Trusts for more information and will publish further analyses about their cost structures.

- The Trusts brand / Corporate PR. The Trusts have chosen to invest in “The Trusts” as a corporate brand. It is notably more prevalent than the equivalent activity of the supermarkets (how often do you see advertising with Progressive or Foodstuffs on it?). Investment in their corporate brand serves to increase the public’s positive perceptions of The Trusts and can be seen to serve two purposes. 1. To influence consumers to feel good about shopping at The Trusts outlets and venues therefore increasing their revenues. 2. To minimise the risk of losing their monopoly rights. It is difficult to quantify the corporate PR spend, as much of it can be construed as a mix of giving back and PR (e.g. sponsorships). If the monopoly were not at risk, it is likely that much less would be spent on corporate PR.

- Compliance costs. Licensing Trusts have to comply with some special requirements, which increase their costs beyond those of a private operator. For example, The Trusts spent $176K on the elections in 2016.

How much of this is in the control of The Trusts? Not much. Their monopoly will most likely be eroded further by online retailers. While they hold their monopoly they are unable to operate outside the district, so they can’t grow to an effective scale. They could drive for efficiency but without owners / shareholders breathing fire from one direction, and competitors pushing hard from another direction, any gains are unlikely to be sustained. And whilst they could scale back their PR spend, as long as they believe the monopoly is in the community’s best interest, it is unlikely they would take this step.

The Trusts want us to believe that introducing competition would undermine their ability to give back, but their profits come from their investments which would be completely unaffected by competition. So actually, what would losing the monopoly put at risk? Perhaps just an over-sized support office.

What do you think? Are there other reasons The Trusts aren’t making ‘super-profits’?

Details of our analysis:

First, let us consider The Trusts as two separate businesses: the first we shall call ‘The Core Trusts’ and the second ‘The Landlord/Investor Trusts’.

- ‘The Landlord/Investor Trusts’ owns real estate and other investments. Its revenues come from rents, dividends, interest and capital gains on its property.

- ‘The Core Trusts’ operates liquor stores, bars and a hotel. Its revenues come from their sales of food, drinks and accommodation.

We have split the income and expenses of The Trusts between these two businesses and also estimated the rents that The Core Trusts would pay to The Landlord/Investor Trusts (i.e. the imputed rents). This analysis gives us a breakdown of the $5.12M published profit as:

| Total pre-tax profits: | Profit attributable to: | ||

| Published pre-tax profit | $5.12M | The Core Trusts (ex-gaming) | ($0.32M) loss |

| Plus Giving back | $0.64M | Gaming venue payments | $1.69M |

| The Landlord/Investor Trusts | $4.39M | ||

| Total | $5.76M | Total | $5.76M |

But surely it just depends on how you split it up? And indeed that’s true. Here is exactly how we made the splits:

The Trusts financial statements provide us with figures for the following: Rental income, Interest income, Dividends income, Revaluation of investment property, Gain/(loss) on sale of investment property. These revenues we assigned to The Landlord/Investor Trusts. The statements also provide a figure for “Other income” which is not explained further – we have assumed half of this “Other income” is attributable to The Landlord/Investor Trusts ($183K). All other income is assigned to The Core Trusts.

We also need to add back in the Giving Back activities of The Trusts which are buried in their income statements under headings such as ‘Administration costs’. The Trusts have provided us with details of their giving back since 2013/14, and we’ve calculated the average give back over the last 5 years as $0.64M per year.

The imputed rents have been calculated as $3.49M per year. This is an estimate of how much The Core Trusts would have paid for leasing the 17 outlets/venues, head office and warehouse which they own and occupy. This was calculated as follows:

- The average lease costs for one premise can be calculated from The Trusts financials. The Trusts operate from 20 leased premises at a cost of $1.73M, which equates to $87K per premise. For 12 of the owned premises; this is the figure we have used (12 x $86K = $1.04M).

- The other premises (The Hangar, The Good Home / The Quality Hotel / West Liquor Lincoln Green, West Liquor New Lynn Central / Support Office / Warehouse) are operated from three sites. For these premises, the lease costs are expected to be greater than $86K each. These sites are (more or less) fully developed and therefore using the current market yield and the Auckland Council valuation is a sound basis for estimation. We assumed a yield of 6.5% which gives lease costs of $37.7M x 6.5% = $2.45M p.a.

All expenses were assigned to The Core Trusts with the exception of ‘Depreciation of freehold buildings’ plus an allowance of $204K to manage the commercial properties (5% of the total rents).

With this calculation, the total rents received are $4.08M which gives a gross yield of 5.9% (total portfolio value = $69.2M using the 2017 Auckland Council valuations).

Alternatively, the imputed rents could be estimated using an opportunity cost approach. A conservative 6.5% gross yield gives an imputed rent value of $4.5M and an annual loss of $1.23M. The table below shows the profit figures using the two approaches.

| Average annual figures 2012/13 – 2016-17($000’s) |

||

| Average lease costs basis | Opportunity cost basis | |

| Profit (loss) before income tax | 5,119 | 5,119 |

| Giving back | 639 | 639 |

| Investment incomes | -1,549 | -1,549 |

| Imputed rents for owned properties | -3,489 | -4,499 |

| Gaming site rental | -1,690 | -1,690 |

| Investment expenses | 651 | 651 |

| CORE Profit ex gaming ex Giving back | -320 | -1,329 |